Bilibili Inc. (NASDAQ: BILI) is one of China’s largest video content platforms. It’s often referred to as the YouTube (NASDAQ: GOOGL) of China. They have similarities and differences with their operating models. Chinese stocks are back in fashion as the government eases restrictions of its zero-COVID policies.

The reopening has sent Chinese stocks skyrocketing like e-commerce sites including Alibaba Group Holding Limited (NASDAQ: BABA), Pinduoduo Inc. (NYSE: PDD), and JD.com, Inc. (NYSE: JD). Even Chinese electric vehicle stocks like NIO, Inc. (NYSE: NIO) and Xpeng, Inc. (NYSE: XPEV) saw double-digit gains. Despite the bear market in stocks, many of the big Chinese internet companies are still growing. Pinduoduo sales rose over 60%. Bilibili saw an 11% rise in quarterly revenues from its year-ago period. Shares have spiked more than 200% off their lows made in October 2022.

Similarities to YouTube

There are many similarities to YouTube. Bilibili is a video-sharing platform where anyone can create a channel and upload user-created content. They can get followers along with allowing viewers to post comments. They can somewhat monetize their channels partially from Bilibili but more so with donations from viewers similar to Super Chat donations on YouTube. The platform also takes a percentage of those. Content creators are also free to strike deals directly with advertisers and charge for memberships aka Patreons for bonus content and features.

Differences with YouTube

There are key differences with YouTube. Bilibili is about a tenth the size on YouTube. While YouTube had its origins as a user created content platform focusing on personal experiences, Bilibili started off as a video platform focusing strictly on anime, comics, and games (ACG). Bilibili was back by Alibaba and rival Tencent Holdings Limited (OTCMKTS: TCEHY).

Bilibili was and is an e-commerce site that monetizes advertising, mobile games and merchandise sales. YouTube shares over half its advertising revenues with content providers that meet requirements, whereas content creators on Bilibili collect much less. Content creators often negotiate directly with advertisers to pitch their products. Bilibili is mainly targeted to Chinese viewers while YouTube is international.

Rollercoaster Price Action

BILI stock is not for the faint of heart. It’s had a rollercoaster ride in the past three years. Just looking at the prices, BILI shares were trading at a pre-COVID high of $29.01 in February 2020, and then fell to a COVID low of $19.25 in March 2020. Shares then skyrocketed to hit a post-pandemic high of $157.40 in February 2021.

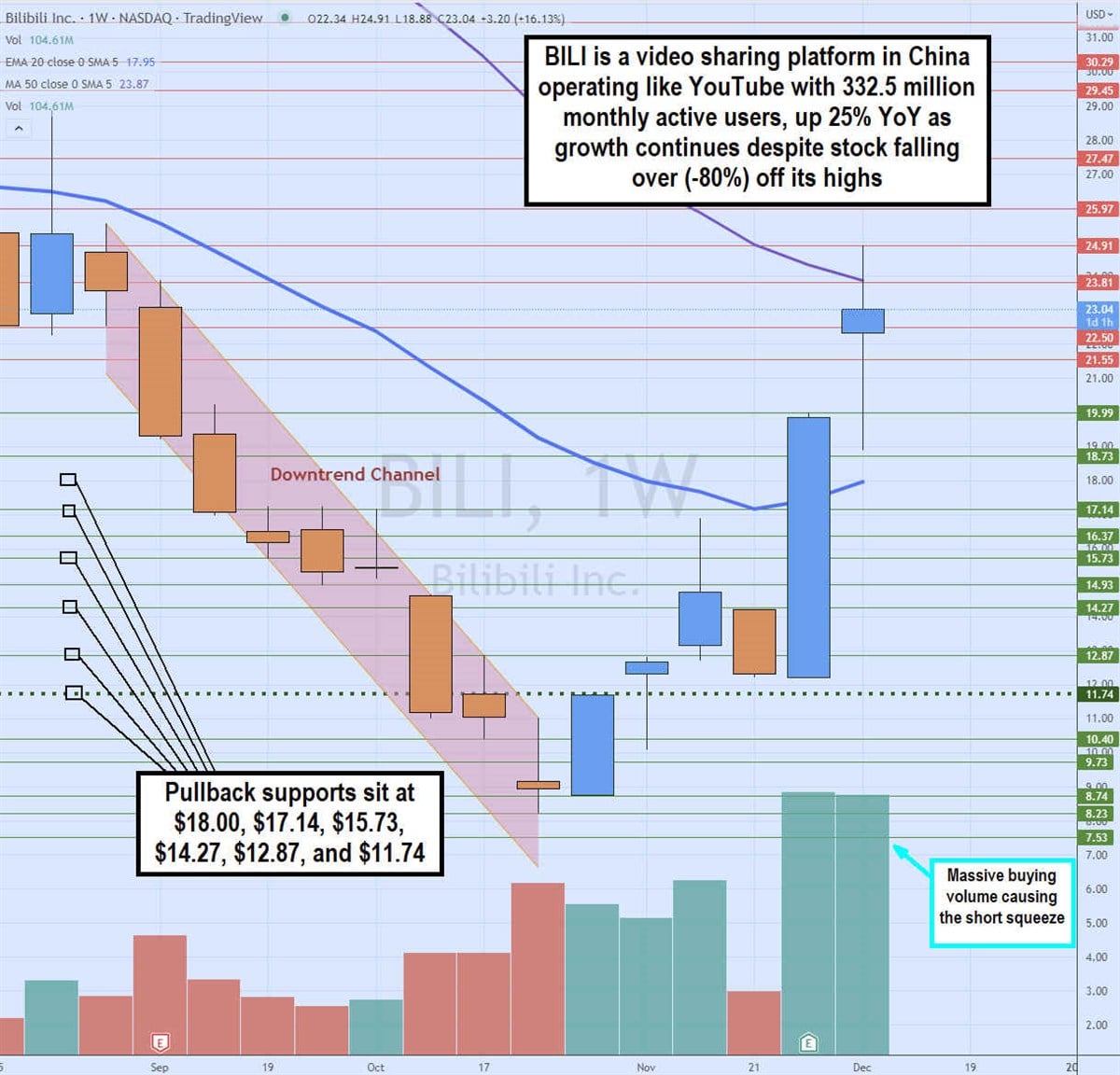

Shares made the long treacherous journey back down to hit a low of $8.23 in October 2022. It formed a weekly market structure low (MSL) buy trigger on the $11.74 breakout at the by mid-November and continued to rally up to 16.88 before falling back down to $12.23 ahead of the earnings release.

The massive volume was triggered upon the Q3 2022 earnings release on Nov. 29, 2022. Shares have squeezed up through the weekly 20-period exponential moving average (EMA) at $18.19 and weekly 50-period MA at $23.92. Volume has exploded with the money flowing into Chinese stocks fueled by the reopening. BILI stock has pullbacks support levels at $18.00, $17.14, $15.73, $14.27, $12.87, and the $11.74 weekly MSL trigger.

Record User Engagements

YouTube has video advertisements that play at the beginning of a video and throughout intervals for non-premium subscribers. This can get distracting and turn off viewers. Bilibili has been able to overlay comments and advertisements while the video is playing making it less intrusive and keep viewers engaged. In fact, the daily time spent on Bilibili hit a record 96-minutes on the platform with 3.7 billion average daily video views, up 64%. It’s also worth noting the relatively young user base as 80% of them are under 24 years old.

Algorithms versus A.I. and Humans

YouTube is operated almost solely through algorithms to generate recommendations, while Bilibili also uses algorithms, it also has administrators watch videos and make recommendations and match them up with viewers. The elephant in the room is censorship. There are certain topics that can be censored in China like political views that conflict with the state, whereas YouTube allows them but will also censor content related to COVID-19.

Impressive Growth But Losses Still Loom

Bilibili reported its fiscal Q3 2022 earnings on Nov. 23, 2022. The Company reported earnings-per-share (EPS) of a loss of (-RMB 4.46) per share beating consensus analyst estimates for a loss of (-RMB 4.66), by RMB 0.20. Revenues climbed 11.3% year-over-year (YoY) to RMB 5.79 billion or $832.16 million, beating analyst estimates for RMB 5.66 billion or $813.45 million. Annual active customer accounts rose 6.5% to 588.3 million.

Bilibili CEO Rui Chen commented, “While our community remains key to our long-term success, we believe it is essential to stay adaptive to the increasingly challenging macro environment. Putting profitability first, we will take additional initiatives to accelerate our monetization and implement cost containment measures including rationalizing headcount planning and cutting sales and marketing expenses, with our goal set to improve our margins and narrow our losses.”

Risks of Restrictions Still Looms

At the end of November 2022, China has started to relax zero-COVID policy rules with 20 conditions helping to slowly reopen its economy after much scrutiny and protests. They furthered relaxed COVID restrictions dropping testing for domestic travel. Health officials are still adamant they are monitoring trends in deaths and resources to gauge further options, which could also include returning back tightening restrictions.